Tuesday, July 21. 2020

SEC Proposes Amendments to Update Form 13F

New Reporting Threshold

Form 13F was first adopted in 1978. At that time, Section 13(f) required a manager to file a report with the SEC if the manager exercises investment discretion with respect to accounts holding certain equity securities (“13(f) securities”) having an aggregate fair market value on the last trading day of any month of any calendar year of at least $100 million. This amount represented a certain proportionate market value of U.S. equities. Since then, the overall value of U.S. public corporate equities has grown from $1.1 trillion to $35.6 trillion, a 30-fold increase. Therefore, the relative significance of managing $100 million has declined considerably. Accordingly, the SEC and its staff have received recommendations to revisit the Form 13F reporting threshold from a variety of sources over the years, including from the SEC’s Office of the Inspector General.

The proposed amendments to Form 13F and Rule 13f-1 would raise the threshold for reporting specified equity securities on Form 13F from $100 million to $3.5 billion. In addition, the proposal would require SEC staff to conduct reviews of the Form 13F reporting threshold every five years and recommend an appropriate adjustment if one is warranted.

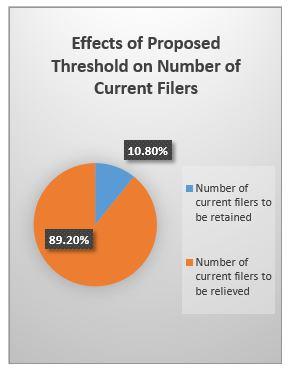

The higher threshold is intended to reflect proportionally the same market value of US equities that $100 million represented in 1975 while achieving the goals of Form 13F as applied to today’s market size. In 1975, filers representing holdings of approximately 75% of the dollar value of all institutional equity security holdings were subject to the reporting requirements. Under the proposed increased threshold, the aggregate value of securities reported by managers would represent approximately 75% of the U.S. equities market as a whole. The proposal would maintain disclosure of over 90% of the dollar value of holdings data currently disclosed through Form 13F, but smaller asset managers, who represent the majority of current filers, would become exempt.

|

|

Estimates are based on SEC staff analysis of Form 13F holdings data reported by institutional investment managers as of December 31, 2018. Source: www.sec.gov.

In addition, the proposal would eliminate the omission threshold that currently permits managers to exclude certain small positions from the form. The proposal also would:

- require managers to report certain numerical identifiers to enhance the usability of the information provided on Form 13F

- make certain technical amendments that would modernize the information reported on Form 13F

- conform the standard for SEC review of requests for confidential treatment of Form 13F information with a recent decision by the US Supreme Court

Reduction in Costs and Burdens to Smaller Managers

The proposal estimates that, for smaller managers that would no longer file reports on Form 13F under the amended threshold, current direct compliance costs could range from $15,000 to $30,000 annually per manager, depending on certain factors. Raising the threshold could thus result in direct compliance cost savings for these managers per year ranging from $68.1 million to $136 million. To investigate this, the SEC requests comment on direct compliance costs associated with Form 13F. Topics of interest include:

- developing and maintaining internal hardware and software systems

- utilizing internal and external legal and compliance resources for advice and review, including analysis of whether holdings qualify for confidential treatment

- preparing the information for submission

- undertaking other reviews or compliance activities as part of the manager’s overall compliance program

The proposal also seeks comment on indirect costs associated with Form 13F. These can include the use of Form 13F data by other market participants to engage in front running (which primarily harms the owners of a portfolio) or copycatting (which potentially harms the portfolio manager) of the investment portfolios of smaller managers. These aspects may increase the costs of investing for smaller managers and hinder their investment performance, with potential effects on their portfolios’ owners. In addition, the proposal discusses:

- the costs to smaller managers of requesting confidential treatment of Form 13F information

- the costs to the SEC associated with staff time and resources spent addressing smaller managers’ inquiries and requests for assistance regarding compliance with Form 13F reporting obligations

Finally, the proposal describes adjustments to the existing burdens for Form 13F for purposes of the Paperwork Reduction Act of 1995 and requests comment on those adjustments, as well as the initial and ongoing annual burden estimates associated with the proposed amendments to Form 13F.

The public comment period for these proposed amendments will be open for 60 days after publication in the Federal Register. You can submit comments using the form available on the SEC’s website or by e-mailing rule-comments@sec.gov with the proposed rules’ reference number in the subject line. You can also use the Federal Rulemaking Portal to submit comments or send your comments by mail to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. In all cases, be sure to reference File Number S7-08-20.

Sources:

Reporting Threshold for Institutional Investment Managers (www.sec.gov)